Solar by state

Solar energy is one of the cleanest, most sustainable sources of energy available. By installing solar panels, homeowners can significantly reduce their carbon footprint, contribute to a greener future, and achieve energy independence. Solar also provides long-term savings on electricity bills and increases home value.

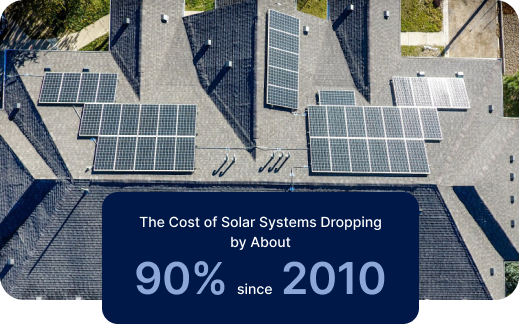

Solar More Affordable Than Ever

As of 2024, the cost of solar panels continues to decline, making solar energy more affordable than ever.

Over the last decade, solar prices have fallen dramatically, with the cost of solar systems dropping by about 90% since 2010. For a typical residential system, post-federal tax credits, homeowners can expect to pay an average of $20,000 for a 10 kW installation.

This is a significant reduction from previous years and highlights the growing affordability of solar energy. With these price drops, the return on investment for solar energy has improved, making it an increasingly attractive option for both residential and commercial properties.

Solar Benefits for All

Regardless of the state, installing solar panels can lead to:

Lower electricity bills

By generating your own electricity, you reduce reliance on the grid.

Energy independence

Solar power allows you to have more control over your energy source, especially during peak usage times.

Increased property value

Homes with solar installations tend to sell for more due to long-term energy savings.

Environmental benefits

Solar energy reduces greenhouse gas emissions, contributing to cleaner air and a healthier planet.

Check Details on Solar in your State

Discover key incentives available in different states that can assist you in transitioning to solar energy.

Ranking of States as for Solar Installations

As of Q2 2024 according to SEIA.

Solar Incentives and Financing

Making Solar Accessible and Affordable

Switching to solar energy has never been more financially rewarding, thanks to a variety of incentives and financing options available across the U.S. From federal tax credits to state-specific exemptions, these programs are designed to make solar energy more affordable for homeowners and businesses alike. In addition, flexible financing options like solar loans, leases, and Power Purchase Agreements (PPAs) provide solutions to suit different financial needs.

Federal Solar Tax Credit

The Federal Investment Tax Credit (ITC) lets you claim 30% of the cost of installing solar panels as a tax credit. This helps lower the total cost of your solar system, covering things like the panels, installation, and permits. The best part? This incentive is available until 2032, making solar more affordable for everyone. After 2032, the credit will begin to decrease, phasing down to 26% in 2033 and 22% in 2034.

Sales and Property Tax Savings

In some states, you won’t have to pay sales tax when buying solar panels, saving you money right at the start. Plus, some states won’t raise your property taxes even though solar panels increase your home’s value. It’s a great way to get more from your investment without paying extra taxes.

Easy Solar Financing Options

You don’t need to pay for solar all at once. There are solar loans that let you pay over time with low interest, or you can choose to lease the panels and pay a set monthly amount. Some programs even let you pay through your property tax bill, so there are flexible options no matter your budget.

Find out Price on Solar in Your State