The renewable energy sector continues to expand, despite policy uncertainty under the Trump administration.

California Solar Incentives: 2025 Overview

California offers outstanding incentives to make solar energy affordable and accessible. With the 30% Residential Clean Energy Credit, homeowners can save significantly on installation costs. California’s net metering program also lets residents earn credits for excess energy, lowering future bills. Plus, additional state rebates and financing options make solar even more attractive. Go solar in…

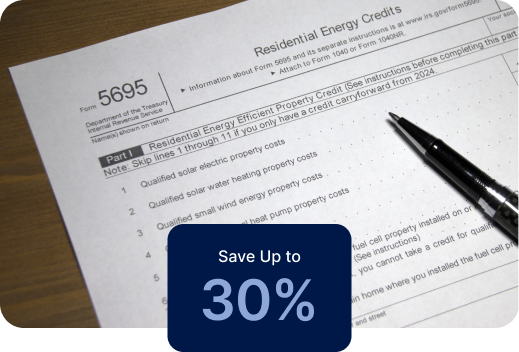

Residential Clean Energy Credit

The Clean Electricity Investment Credit (previously called the Federal Investment Tax Credit) helps lower the cost of installing solar panels by 30%. This credit covers everything: the solar panels, equipment, labor, permits, and even sales tax.

For example, as of 2025 the average cost of a 10 kW solar system in the U.S. typically ranges between $21,000 and $29,500 before applying any federal tax incentives. After claiming the 30% Clean Electricity Investment Credit, the price drops to around $14,980 to $21,070, depending on the state and other factors like equipment quality and labor costs.

To claim this credit, you must buy your solar system with cash or a loan (leases don’t qualify). You also need to owe enough in taxes to claim the credit, but if you don’t, you can carry it over to future years until 2034.

Claiming the Clean Electricity Investment Credit is simple!

Step 1

Print IRS Form 3468

Step 2

Fill out the form using info from your installer

Step 3

Submit it when you file your taxes

What are the top solar incentives in California?

Besides the Clean Electricity Investment Credit (former ITC), homeowners can take advantage of several outstanding incentives that significantly enhance the return on investment for solar panels. Here are some of the most effective ways to lower your solar installation costs.

Incentive

Savings

Summary

Residential Renewable Energy Tax Credit

A taxpayer may claim a credit of 30% of qualified expenditures, after deducting incentives, with no upper limit for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Expenditures with respect to the equipment are treated as made when the installation is completed. If the installation is at a new home, the “placed in service” date is the date of occupancy by the homeowner. Expenditures include labor costs for on-site preparation, assembly or original system installation, and for piping or wiring to interconnect a system to the home. If the federal tax credit exceeds tax liability, the excess amount may be carried forward to the succeeding taxable year. The excess credit may be carried forward until 2019, but it is unclear whether the unused tax credit can be carried forward after then.

Residential Solar Incentive

Sacramento Municipal Util Dist is offering an incentive of $500.00 per residential solar system for PV systems that are installed on the customer’s side. The application process to receive incentives for your solar power system will be handled by your contractor.

Residential Solar Incentive

Sacramento Municipal Util Dist is offering an incentive of $300.00 per residential solar system for PV systems that are installed on the customer side. The application process to receive incentives for your solar power system will be handled by your contractor.

Residential Renewable Energy Tax Credit

A taxpayer may claim a credit of 26% of qualified expenditures, after deducting incentives, with no upper limit for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Expenditures with respect to the equipment are treated as made when the installation is completed. If the installation is at a new home, the “placed in service” date is the date of occupancy by the homeowner. Expenditures include labor costs for on-site preparation, assembly or original system installation, and for piping or wiring to interconnect a system to the home. If the federal tax credit exceeds tax liability, the excess amount may be carried forward to the succeeding taxable year. The excess credit may be carried forward until 2019, but it is unclear whether the unused tax credit can be carried forward after then.

Residential Renewable Energy Tax Credit

A taxpayer may claim a credit of 22% of qualified expenditures, after deducting incentives, with no upper limit for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Expenditures with respect to the equipment are treated as made when the installation is completed. If the installation is at a new home, the “placed in service” date is the date of occupancy by the homeowner. Expenditures include labor costs for on-site preparation, assembly or original system installation, and for piping or wiring to interconnect a system to the home. If the federal tax credit exceeds tax liability, the excess amount may be carried forward to the succeeding taxable year. The excess credit may be carried forward until 2019, but it is unclear whether the unused tax credit can be carried forward after then.

Residential Renewable Energy Tax Credit

A taxpayer may claim a credit of 30% for the installation which was between 2022-2032 (Systems installed on or before December 31, 2019 were also eligible for a 30% tax credit), with no upper limit for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Expenditures with respect to the equipment are treated as made when the installation is completed. If the installation is at a new home, the placed in service date is the date of occupancy by the homeowner. Expenditures include labor costs for on-site preparation, assembly or original system installation, and for piping or wiring to interconnect a system to the home.

Residential Solar Incentive – Estimated Performance Based Buydown

The LADWP Solar Photovoltaic(PV) Incentive Program (Incentive Program) provides financial incentives to LADWP customers who purchase or lease, and install their own solar power systems in accordance with Guidelines and is only available to LADWP electric customers. The LADWP currently provides a Los Angeles Manufacturing Credit (LAMC) for qualifying PV equipment manufactured in Los Angeles as approved by the LADWP according to Section 7.0 of these Guidelines. The goal of the LAMC is to promote local economic development through manufacturing and job creation within the City of Los Angeles and to reduce costs through increased volume and competition. The LADWP estimated performance-based incentive is a one-time payment calculated by multiplying the proposed system output by the incentive level and the ratio of the proposed solar system’s expected solar production over the simulated solar production of an optimal reference system in optimal conditions.

Residential Solar Incentive – Estimated Performance Based Buydown

The LADWP Solar Photovoltaic(PV) Incentive Program (Incentive Program) provides financial incentives to LADWP customers who purchase or lease, and install their own solar power systems in accordance with Guidelines and is only available to LADWP electric customers. The LADWP currently provides a Los Angeles Manufacturing Credit (LAMC) for qualifying PV equipment manufactured in Los Angeles as approved by the LADWP according to Section 7.0 of these Guidelines. The goal of the LAMC is to promote local economic development through manufacturing and job creation within the City of Los Angeles and to reduce costs through increased volume and competition. The LADWP estimated performance-based incentive is a one-time payment calculated by multiplying the proposed system output by the incentive level and the ratio of the proposed solar system’s expected solar production over the simulated solar production of an optimal reference system in optimal conditions.

Residential Solar Incentive – Estimated Performance Based Buydown

The LADWP Solar Photovoltaic(PV) Incentive Program (Incentive Program) provides financial incentives to LADWP customers who purchase or lease, and install their own solar power systems in accordance with Guidelines and is only available to LADWP electric customers. The LADWP currently provides a Los Angeles Manufacturing Credit (LAMC) for qualifying PV equipment manufactured in Los Angeles as approved by the LADWP according to Section 7.0 of these Guidelines. The goal of the LAMC is to promote local economic development through manufacturing and job creation within the City of Los Angeles and to reduce costs through increased volume and competition. The LADWP estimated performance-based incentive is a one-time payment calculated by multiplying the proposed system output by the incentive level and the ratio of the proposed solar system’s expected solar production over the simulated solar production of an optimal reference system in optimal conditions.

SGIP Small Residential Energy Storage Incentive – San Diego Gas & Electric – Step 2

Total energy storage incentive funds are divided across five steps. Energy storage incentives generally decline by $0.05/Wh between incentive steps. However, if the previous incentive step becomes fully subscribed within 10 calendar days across all Program Administrator territories, the incentive decline to the next step for large-scale storage projects not claiming the ITC and the small residential carve-out- will be $0.10/Wh rather than $0.05/Wh. The incentive for large-scale storage projects claiming the ITC will maintain a 72% differential from the incentive rate for non-ITC large-scale storage projects in all steps.

SGIP Small Residential Energy Storage Incentive – Pacific Gas & Electric – Step 3

Total energy storage incentive funds are divided across five steps. Energy storage incentives generally decline by $0.05/Wh between incentive steps. However, if the previous incentive step becomes fully subscribed within 10 calendar days across all Program Administrator territories, the incentive decline to the next step for large-scale storage projects not claiming the ITC and the small residential carve-out- will be $0.10/Wh rather than $0.05/Wh. The incentive for large-scale storage projects claiming the ITC will maintain a 72% differential from the incentive rate for non-ITC large-scale storage projects in all steps.

Pasadena Solar Initiative – EPBB Incentive, Low-Income (Closed)

Pasadena Water & Power (PWP) offers its electric customers a rebate for photovoltaic (PV) installations, with a goal of helping to fund the installation of 14 megawatts (MW) of solar power by 2017. The rebate amount varies depending on the customer class installing the system and the system’s size. Systems up to 30 kilowatts (kW) are eligible for the Expected Performance Based Buydown (EPBB) or can opt for the performance based incentive (PBI). The EPBB provides a one-time lump sum payment after installation and inspection approval based on the system’s estimated AC energy output. The energy output is estimated using the California Energy Commission’s Clean Power Estimator, which accounts for installation factors such as current and future shading and system orientation. The PBI awards payments based on the actual metered electricity production of the system during its first five years. Larger systems, over 30 kW and up to 1,000 kW, are only eligible for the PBI.

Pasadena Solar Initiative – EPBB Incentive (Closed)

Pasadena Water & Power (PWP) offers its electric customers a rebate for photovoltaic (PV) installations, with a goal of helping to fund the installation of 14 megawatts (MW) of solar power by 2017. The rebate amount varies depending on the customer class installing the system and the system’s size. Systems up to 30 kilowatts (kW) are eligible for the Expected Performance Based Buydown (EPBB) or can opt for the performance based incentive (PBI). The EPBB provides a one-time lump sum payment after installation and inspection approval based on the system’s estimated AC energy output. The energy output is estimated using the California Energy Commission’s Clean Power Estimator, which accounts for installation factors such as current and future shading and system orientation. The PBI awards payments based on the actual metered electricity production of the system during its first five years. Larger systems, over 30 kW and up to 1,000 kW, are only eligible for the PBI.

Pasadena Solar Initiative – EPBB Incentive, Low-Income (Closed)

Pasadena Water & Power (PWP) offers its electric customers a rebate for photovoltaic (PV) installations, with a goal of helping to fund the installation of 14 megawatts (MW) of solar power by 2017. The rebate amount varies depending on the customer class installing the system and the system’s size. Systems up to 100 kilowatts (kW) are eligible for the Expected Performance Based Buydown (EPBB) while systems over 100 kilowatts (kW) are eligible for the Performance Based Incentive (PBI). The EPBB provides a one-time lump sum payment after installation and inspection approval based on the system’s estimated AC energy output. The energy output is estimated using the California Energy Commission’s Clean Power Estimator, which accounts for installation factors such as current and future shading and system orientation. The PBI awards payments based on the actual metered electricity production of the system during its first five years. Larger systems, over 100 kW and up to 1,000 kW, are only eligible for the PBI.

Pasadena Solar Initiative – EPBB Incentive, Low-Income (Closed)

Pasadena Water & Power (PWP) offers its electric customers a rebate for photovoltaic (PV) installations, with a goal of helping to fund the installation of 14 megawatts (MW) of solar power by 2017. The rebate amount varies depending on the customer class installing the system and the system’s size. Systems up to 100 kilowatts (kW) are eligible for the Expected Performance Based Buydown (EPBB) while systems over 100 kilowatts (kW) are eligible for the Performance Based Incentive (PBI). The EPBB provides a one-time lump sum payment after installation and inspection approval based on the system’s estimated AC energy output. The energy output is estimated using the California Energy Commission’s Clean Power Estimator, which accounts for installation factors such as current and future shading and system orientation. The PBI awards payments based on the actual metered electricity production of the system during its first five years. Larger systems, over 100 kW and up to 1,000 kW, are only eligible for the PBI.

Pasadena Solar Initiative – EPBB Incentive (Closed)

Pasadena Water & Power (PWP) offers its electric customers a rebate for photovoltaic (PV) installations, with a goal of helping to fund the installation of 14 megawatts (MW) of solar power by 2017. The rebate amount varies depending on the customer class installing the system and the system’s size. Systems up to 100 kilowatts (kW) are eligible for the Expected Performance Based Buydown (EPBB) while systems over 100 kilowatts (kW) are eligible for the Performance Based Incentive (PBI). The EPBB provides a one-time lump sum payment after installation and inspection approval based on the system’s estimated AC energy output. The energy output is estimated using the California Energy Commission’s Clean Power Estimator, which accounts for installation factors such as current and future shading and system orientation. The PBI awards payments based on the actual metered electricity production of the system during its first five years. Larger systems, over 100 kW and up to 1,000 kW, are only eligible for the PBI.

Residential Photovoltaic (PV) Rebate Program

Riverside Public Utilities (RPU) makes owning solar power easy and rewarding with our Residential Photovoltaic (PV) Rebate Program. This leading-edge rebate program provides financial incentives to RPU electric customers who purchase and install PV systems on their homes. There will be no cap on residential system rebate amount. System size must still abide by net metering rules.

Residential Photovoltaic (PV) Rebate Program

Riverside Public Utilities (RPU) makes owning solar power easy and rewarding with our Residential Photovoltaic (PV) Rebate Program. This leading-edge rebate program provides financial incentives to RPU electric customers who purchase and install PV systems on their homes. There will be no cap on residential system rebate amount. System size must still abide by net metering rules.

Residential Photovoltaic (PV) Rebate Program

Riverside Public Utilities (RPU) makes owning solar power easy and rewarding with our Residential Photovoltaic (PV) Rebate Program. This leading-edge rebate program provides financial incentives to RPU electric customers who purchase and install PV systems on their homes. There will be no cap on residential system rebate amount. System size must still abide by net metering rules.

SGIP Small Residential Energy Storage Incentive – Southern California Edison – Step 3

Total energy storage incentive funds are divided across five steps. Energy storage incentives generally decline by $0.05/Wh between incentive steps. However, if the previous incentive step becomes fully subscribed within 10 calendar days across all Program Administrator territories, the incentive decline to the next step for large-scale storage projects not claiming the ITC and the small residential carve-out- will be $0.10/Wh rather than $0.05/Wh. The incentive for large-scale storage projects claiming the ITC will maintain a 72% differential from the incentive rate for non-ITC large-scale storage projects in all steps.

Residential Photovoltaic Rebate

Lassen Municipal Utility District (LMUD) is providing incentives for its customers to purchase solar electric photovoltaic (PV) systems. Rebate levels will decrease annually over the life of the program. Systems must be interconnected and must meet all other requirements detailed in the program guidelines. Homes wishing to receive a rebate must have an LMUD administered energy audit performed and must agree to pursue any efficiency improvement identified with a three year payback or less.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $2.8/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $2.6/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Photovoltaic Rebate

Lassen Municipal Utility District (LMUD) is providing incentives for its customers to purchase solar electric photovoltaic (PV) systems. Rebate levels will decrease annually over the life of the program. Through June 30, 2014, rebates of $3.00 per watt-AC up to $5,000 are available for residential systems. Systems must be interconnected and must meet all other requirements detailed in the program guidelines. Homes wishing to receive a rebate must have an LMUD administered energy audit performed and must agree to pursue any efficiency improvement identified with a three year payback or less.

Residential Photovoltaic Rebate

Lassen Municipal Utility District (LMUD) is providing incentives for its customers to purchase solar electric photovoltaic (PV) systems. Rebate levels will decrease annually over the life of the program. Systems must be interconnected and must meet all other requirements detailed in the program guidelines. Homes wishing to receive a rebate must have an LMUD administered energy audit performed and must agree to pursue any efficiency improvement identified with a three year payback or less.

Residential Photovoltaic Rebate

Lassen Municipal Utility District (LMUD) is providing incentives for its customers to purchase solar electric photovoltaic (PV) systems. Rebate levels will decrease annually over the life of the program. Through June 30, 2016, rebates of $2.60 per watt-AC up to $3,000 are available for residential systems. Systems must be interconnected and must meet all other requirements detailed in the program guidelines. Homes wishing to receive a rebate must have an LMUD administered energy audit performed and must agree to pursue any efficiency improvement identified with a three year payback or less. For systems larger than 5 kW AC, the customer must show justification of the system sizing with the submittal of the initial application, demonstrating that the system is sized not to exceed annual household electric energy use.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $2.42/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $2.25/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $2.09/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $1.95/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $1.81/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates of $1.68/watt (AC) up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Photovoltaic Rebate

Lassen Municipal Utility District (LMUD) is providing incentives for its customers to purchase solar electric photovoltaic (PV) systems. Rebate levels will decrease annually over the life of the program. Through June 30, 2017, rebates of $2.72 per watt-AC up to $3,000 are available for residential systems. Systems must be interconnected and must meet all other requirements detailed in the program guidelines. Homes wishing to receive a rebate must have an LMUD administered energy audit performed and must agree to pursue any efficiency improvement identified with a three year payback or less. For systems larger than 5 kW AC, the customer must show justification of the system sizing with the submittal of the initial application, demonstrating that the system is sized not to exceed annual household electric energy use.

Residential Solar Rebate

Plumas-Sierra Rural Electric Cooperative (PSREC) is offering rebates up to lesser of $6000 or 25 kW to encourage the installation of high-quality solar photovoltaic (PV) systems. Systems must be installed in conformance with the manufacturer’s specifications and all applicable electrical and building codes and standards. PSREC reserves the right to reject a system from interconnection if deemed unsafe.

Residential Solar Support Rebate

Burbank Water & Power offers customers either an up-front capacity-based rebate for PV systems, or a production-based incentive (PBI) with a maximum payment of $400000/yr. These incentives decline over time as defined capacity goals are met, eventually declining to zero by the end of 2016. The program may change at any time to address market conditions. The highest rebate, Tier 3, is for schools, non-profits, & affordable housing & is available for only one project per fiscal year. Otherwise, these projects will qualify for the commercial rebate. Owners of systems smaller than 30kW CEC-AC in capacity have the option to receive a one-time up-front payment (EPBB) based on the expected performance determined by PowerClerk rebate application software. Otherwise, these customers may elect to receive the PBI for 5 years of monthly payments, based on production. PV systems over 30kW CEC-AC in size are only eligible to receive PBI. Incentives for systems over 30kW, however, have been suspended through August 2013.

Residential Solar Support Rebate

Burbank Water and Power (BWP) offers customers an up-front capacity-based rebate for photovoltaic (PV) systems up to 30 kW. These incentives decline over time as defined capacity goals are met, eventually declining to zero by the end of 2016. The program may change at any time to address market conditions.

Residential Solar Support Rebate

Burbank Water and Power (BWP) offers customers an up-front capacity-based rebate for photovoltaic (PV) systems up to 30 kW. These incentives decline over time as defined capacity goals are met, eventually declining to zero by the end of 2016. The program may change at any time to address market conditions.

Residential Solar Support Rebate

Burbank Water and Power (BWP) offers customers an up-front capacity-based rebate for photovoltaic (PV) systems up to 30 kW. By law (Senate Bill 1), solar rebates will decline over time such that by January 1, 2017 no solar rebates must be provided. The program may change at any time to address market conditions.

PV Residential Buydown (Closed)

Anaheim Public Utilities offers financial incentives, in the form of rebates, for those who install solar energy systems on their homes in Anaheim. Funding for this program is limited and will be allocated to qualified projects on a lottery-based system where each application will have equal chance of receiving a rebate. At the end of the open application period, applications will be randomly shuffled and assigned a lottery number. Applications will then be approved numerically starting with lottery number one. Approval will continue as long as program funds are available.

Residential Solar Photovoltaic – EPBI Incentive (Closed)

MID’s Solar PV Incentive Programs are part of a comprehensive statewide solar program created by Senate Bill 1 (SB1). SB1 establishes three goals: 1. To install 3,000 megawatts (MW) of distributed solar PV capacity in California by the end of 2016. 2. To establish a self-sufficient solar industry in which solar energy systems are a viable mainstream option in 10 years. 3. To place solar energy systems on 50% of new homes in 13 years. The MID Solar PV Incentive Programs provide incentives for residential and non-residential customers for both new and existing structures. For all projects, energy efficiency, the expected performance of the system, as well as the design and installation of the system, will determine the incentive amount. Systems up to 30 kilowatts (kW) in capacity can receive an up-front capacity-based incentive.

Residential Solar Photovoltaic – PBI Incentive (Closed)

MID’s Solar PV Incentive Programs are part of a comprehensive statewide solar program created by Senate Bill 1 (SB1). SB1 establishes three goals: 1. To install 3,000 megawatts (MW) of distributed solar PV capacity in California by the end of 2016. 2. To establish a self-sufficient solar industry in which solar energy systems are a viable mainstream option in 10 years. 3. To place solar energy systems on 50% of new homes in 13 years. The MID Solar PV Incentive Programs provide incentives for residential and The MID Solar PV Incentive Programs provide incentives for residential and non-residential customers for both new and existing structures. For all projects, energy efficiency, the expected performance of the system, as well as the design and installation of the system, will determine the incentive amount. Systems up to 30 kilowatts (kW) in capacity can receive an up-front capacity-based incentive. Systems greater than 30 kW and up to 1,000 kW (1 MW) can receive a performance-based incentive.

Residential Solar Photovoltaic – EPBI Incentive (Closed)

MID’s Solar PV Incentive Programs are part of a comprehensive statewide solar program created by Senate Bill 1 (SB1). SB1 establishes three goals: 1. To install 3,000 megawatts (MW) of distributed solar PV capacity in California by the end of 2016. 2. To establish a self-sufficient solar industry in which solar energy systems are a viable mainstream option in 10 years. 3. To place solar energy systems on 50% of new homes in 13 years. The MID Solar PV Incentive Programs provide incentives for residential and non-residential customers for both new and existing structures. For all projects, energy efficiency, the expected performance of the system, as well as the design and installation of the system, will determine the incentive amount. Systems up to 30 kilowatts (kW) in capacity can receive an up-front capacity-based incentive.

Solar Electric Rebate – EPBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Solar Electric Rebate – PBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Solar Electric Rebate – PBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Solar Electric Rebate – EPBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Solar Electric Rebate – EPBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Solar Electric Rebate – PBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Solar Electric Rebate – PBI

Turlock Irrigation District (TID) offers an incentive program to their customers who install solar photovoltaic (PV) systems. In keeping with the terms of the California Solar Initiative, the incentive payment levels will decline over the life of the program in 10 steps as certain MW levels of PV systems are installed within the District. Residential systems 30 kW or larger will receive a performance-based incentive (PBI) for the actual electricity produced by the system. PBI payments are made monthly for a period of 5 years. All existing customers will be required to have an energy efficiency audit conducted for their home or business as part of the PV reservation. This audit will be provided by TID.

Residential PV Rebate

Silicon Valley Power is offering incentives to make installing and generating electricity from PV systems more affordable for you. These incentives are in the form of rebates to Santa Clara residents and businesses for new installations of photovoltaic (PV) systems. Residents are eligible for a rebate for installing a PV system which meets their existing load up to 10 Kilowatts (kW) AC in size. Rebate amounts will be reduced as SVP reaches installation targets.

Disclaimer: The information provided here regarding solar incentives, tax credits, and rebates is for general informational purposes only and may vary based on your specific circumstances. For exact details, eligibility requirements, and current rates, we recommend consulting a certified solar installer or a tax professional. Incentives can differ by location, utility provider, and individual project, so it’s important to get personalized advice for your solar installation. Always verify the most up-to-date information from your local solar installer to understand how these incentives apply to your project.

Knowledge Base

Find everything you need to know about solar in your state and nationwide

Get a Quote

Discover the Ideal Solar System for Your Home in Just a Few Clicks!