This year’s COP is critical as the world aims to move beyond pledges and toward measurable outcomes.

Ohio Solar Incentives: 2024 Overview

Ohio offers strong incentives to make solar energy affordable. Homeowners can benefit from the 30% Residential Clean Energy Credit, and the state’s net metering policy lets residents earn credits for excess energy, reducing future bills. With additional utility rebates available, going solar in Ohio is a smart choice to save on energy costs and support…

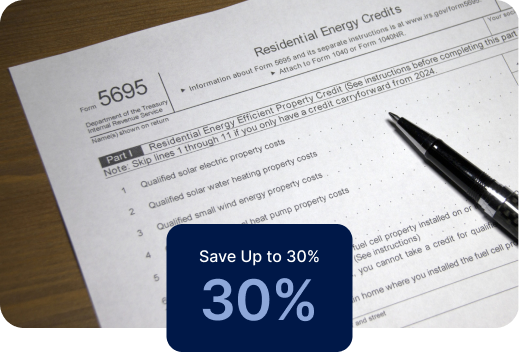

Residential Clean Energy Credit

The Residential Clean Energy Credit (previously called the Federal Investment Tax Credit) helps lower the cost of installing solar panels by 30%. This credit covers everything: the solar panels, equipment, labor, permits, and even sales tax.

For example, as of 2024 the average cost of a 10 kW solar system in the U.S. typically ranges between $21,000 and $29,500 before applying any federal tax incentives. After claiming the 30% Federal Solar Tax Credit, the price drops to around $14,980 to $21,070, depending on the state and other factors like equipment quality and labor costs.

To claim this credit, you must buy your solar system with cash or a loan (leases don’t qualify). You also need to owe enough in taxes to claim the credit, but if you don’t, you can carry it over to future years until 2034.

Claiming the ITC is simple!

Step 1

Print IRS Form 5695

Step 2

Fill out the form using info from your installer

Step 3

Submit it when you file your taxes

What are the top solar incentives in Ohio?

Besides the Residential Clean Energy Credit, [State] homeowners can take advantage of several outstanding incentives that significantly enhance the return on investment for solar panels. Here are some of the most effective ways to lower your solar installation costs.

Incentive

Savings

Summary

Disclaimer: The information provided here regarding solar incentives, tax credits, and rebates is for general informational purposes only and may vary based on your specific circumstances. For exact details, eligibility requirements, and current rates, we recommend consulting a certified solar installer or a tax professional. Incentives can differ by location, utility provider, and individual project, so it’s important to get personalized advice for your solar installation. Always verify the most up-to-date information from your local solar installer to understand how these incentives apply to your project.

Knowledge Base

Find everything you need to know about solar in your state and nationwide

Get a Quote

Discover the Ideal Solar System for Your Home in Just a Few Clicks!