Image source: Canva.com

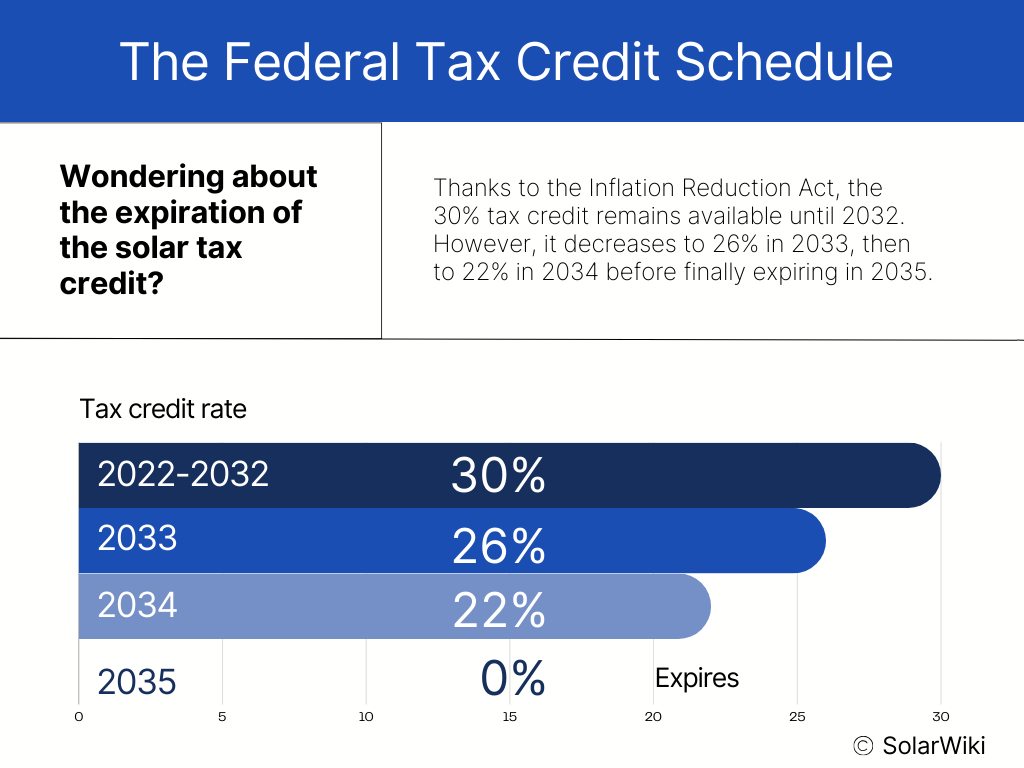

Understanding the Residential Clean Energy Credit

The Residential Clean Energy Credit, commonly known as the Federal Solar Tax Credit, is an incentive available to individuals who install solar panels or other clean energy equipment on their property. This tax credit amounts to 30% of the installation costs and has the potential to significantly decrease the amount you owe in federal income taxes, potentially saving you thousands of dollars.

Curious about how the federal solar tax credit might affect your tax refund? Here’s the scoop: When you claim this credit, it can indeed boost your refund, contingent on factors like your tax liability and withheld amounts.

Essentially, this credit slashes your tax bill. So, if you’ve already had sufficient funds withheld from your pay to cover your tax liability, you’ll receive your standard refund plus the value of the tax credit.

To illustrate, let’s say you splurged $30,000 on solar in 2024, netting a $9,000 tax credit (30% of $30,000). If your tax bill amounts to $30,000 but you’ve already had $35,000 withheld from your pay throughout the year, your refund would tally up to $14,000: $9,000 from the tax credit and $5,000 from your withheld income taxes.

Here’s the breakdown:

Solar installation cost

$30,000

Solar tax credit

$9,000

Tax bill

$30,000

Withheld income taxes

$35,000

Refund Calculation Example

The refund in this case is:

($35,000 – $30,000) + $9,000 = $14,000

Here’s how it works: The 30% solar tax credit reduces your $30,000 tax bill by $9,000. Combined with $5,000 in excess withheld income taxes, your total refund amounts to $14,000.

The Catch

The solar tax credit doesn’t always increase your refund. If you haven’t had enough tax withheld to cover your total liability, the credit will only reduce what you owe – it won’t boost your refund.

Form 5695: How to Claim

What Happens if Your Tax Liability is Too Low?

The Residential Clean Energy Credit is nonrefundable, meaning it cannot reduce your tax bill below $0. However, if the credit exceeds your tax liability, the unused portion rolls over to the following year.

Example:

If your solar tax credit is $6,000 but your tax liability is only $5,000, your federal tax bill drops to $0. The remaining $1,000 will roll over to reduce next year’s tax bill.

No Need to Worry About Tracking

Once the credit is applied, any remaining rollover amount is documented on your tax return. Most tax software automatically tracks this for future filings and generates a schedule showing the applied credit and the carryover amount – making it easy for you or your tax preparer.

Additional Savings

According to a White House release, families who install rooftop solar or battery storage can save up to 30% on installation costs through the tax credit and reduce energy bills by nearly $400 per year.

Disclaimer: The information presented in this article is meant to offer a general understanding of the federal solar tax credit for homeowners considering solar installations. However, it should not be taken as official financial advice. If you are seriously contemplating installing solar products, we recommend using your best judgment and consulting with a qualified tax professional to ensure you make informed decisions based on your specific circumstances.

Benefits of the Residential Clean Energy Credit

In 2024, it stands at 30% of your solar installation expenses. With the average solar setup ringing in at roughly $20,000, you’re looking at an average tax credit of around $6,000.

Unlike a deduction, which reduces your taxable income, a tax credit directly reduces the amount of taxes you owe. If you’ve overpaid your taxes during the year, this credit can even result in a refund from the IRS. However, it cannot exceed your total tax liability.

The Inflation Reduction Act has significantly impacted American workers and families, especially in underserved communities. External estimates indicate that the Act’s clean energy and climate provisions have created over 170,000 clean energy jobs in the first year after its passing. During this first year, companies have committed more than $110 billion to clean energy manufacturing investments. The legislation also provides billions of dollars to help communities withstand the effects of climate change.

The White House official statement provides more details on how the IRA has influenced the lives of Americans over its first year.

Eligibility for the Residential Clean Energy Credit

While most Americans are eligible, there are specific criteria to meet.

Eligibility Criteria

Ownership of the solar panel system

To claim the tax credit, you must buy the solar panels outright with cash or a loan. If you opt for a solar lease or a power purchase agreement (PPA), you won’t qualify for the tax credit.

Taxable income

The tax credit offsets your tax liability. If you have no tax liability, you can’t immediately benefit from the incentive. However, you may carry the credit forward if your tax liability rises in subsequent years.

Installation location

The solar system must be set up at your primary or secondary residence. Only the individual residing at the property can claim the Residential Clean Energy credit. Rental properties are ineligible.

Original installation claim

Once installed, the tax credit can only be claimed for the initial equipment installation. If you relocate the panels to another property, you forfeit the tax credit. Nonetheless, you can still claim the credit for expenses incurred when expanding an existing solar system.

Income Limits for the Residential Clean Energy Credit

There’s good news: No such limits exist. As long as you have tax liability and your system qualifies, you can claim the credit! The federal tax credit typically covers most expenses related to solar panel installation, encompassing:

Equipment

This includes the solar panels themselves, along with wiring, racking, and inverters.

Contract labor

Costs for labor involved in site prep, installation, planning, permits, and inspections are covered.

Sales tax

Any sales tax linked to the aforementioned expenses is also eligible for the tax credit.

However, certain expenses don’t qualify. Roof replacements and extended warranty coverage costs aren’t covered by the tax credit. Notably, financing expenses aren’t factored into your tax credit value.

Steps to Apply for the Residential Clean Energy Credit

Looking to apply for the federal solar tax credit? It’s a breeze! Here’s what you’ll need:

1. Tax Form 5695: You can snag this form from the IRS website.

2. Installation cost: Gather this figure from your installer’s contract or invoice.

3. Tax liability amount: This can be found on Form 1040, line 18.

The IRS website provides comprehensive instructions on how to file Form 1040, guiding taxpayers through the process step-by-step.

If you’re DIY-ing your taxes, simply download Form 5695 and its instructions from the IRS website. The instructions are straightforward, making claiming the credit a cinch.

Using tax software? You’ll likely need to hunt for Form 5695, add it to your tax documents, and input relevant info, like installation costs. The software handles the math, computing your final tax liability.

Opting for a tax preparer? Just provide them with your system’s price, and they’ll take care of the rest.

Key Points

- The Residential Clean Energy Credit offers a significant income tax benefit, providing a dollar-for-dollar credit equal to 30% of solar installation costs.

- For an average $30,000 solar system, this tax credit amounts to $9,000, reducing the overall cost of installation.

- The Inflation Reduction Act has extended the federal solar tax credit until 2035, offering homeowners an extended opportunity to benefit from this incentive.

- To qualify for the federal solar tax credit, homeowners must own the solar panels, have taxable income, and install them at their primary or secondary residence.

- Eligible equipment for the federal tax credit includes photovoltaic solar installations, battery storage, solar water heaters, geothermal pumps, fuel cells, and wind turbines.

Combining the Federal Tax Credit with Local and Utility Solar Incentives

Yes, indeed! You can stack the federal solar tax credit with other available solar incentives. However, the type of incentive can tweak how the tax credit is calculated. Here’s the lowdown:

Utility rebates

Typically, if you snag a rebate from your utility, it’s subtracted from your total costs before the federal tax credit kicks in. This trims your federal tax credit’s value, but you gain from the extra incentive.

For instance, if your solar setup costs $20,000 and you score a $1,000 utility rebate, the tax credit’s based on the $19,000 post-rebate price.

Here’s the formula to gauge your tax credit post-utility incentive:

30% x (Total system cost – Utility rebate amount) = Federal tax credit value

State solar tax credits

Some states offer their own solar tax credits, akin to the federal one. These credits chip away at state income tax liability.

While a state tax credit won’t alter your federal credit’s value, claiming it affects the taxable income you report on federal taxes.

Have a look at our Solar by State page for details in your state.

Performance-based incentives compensate solar homeowners based on their solar system’s energy output. These incentives typically don’t affect your federal tax credit’s value.

You might find these incentives as a separate line item on your electricity bill or receive them as a separate payment from your utility provider.

Certain states offer Solar Renewable Energy Credits (SRECs), where solar owners earn certificates for every 1,000 kWh of solar energy generated. These certificates can be sold to utilities or SREC aggregators, providing an additional income stream.

In some instances, installers may purchase SRECs upfront. If so, it’s wise to consult a tax professional regarding any potential impact on your solar tax credit value.

The optimal time to claim the solar tax credit is now. While you have a decade to avail the full 30% tax credit, delaying isn’t necessarily wise. Investing in solar sooner rather than later is almost always advantageous. By installing solar promptly, you commence saving money sooner, redirecting funds from hefty electricity bills to more meaningful endeavors.

Discover the Ideal Solar System for Your Home in Just a Few Clicks!

The current moment presents an unparalleled opportunity for solar investment. Local solar incentives might expire well before the federal tax credit. Consider net metering, for instance, which compensates you at the full electricity rate for the solar energy you contribute to the grid. Many utilities are phasing out net metering or reducing payments to solar customers.

To secure optimal solar savings, it’s prudent to install solar before incentives like net metering and utility rebates fade away.

Federal Solar Tax Credit FAQs

What’s the value of the federal solar tax credit?

In 2024, the federal tax credit for solar installations stands at 30% of the solar installation expenses. While the average tax credit is approximately $6,000, your actual credit amount hinges on your installation’s specific costs.

When do I claim the solar tax credit?

You claim the tax credit in the tax year when the solar system was installed. For instance, if you installed solar in 2022, you’d apply for the tax credit when filing your taxes for 2023. If you missed claiming it, you can file an amended return.

Can I use the solar tax credit with a loan?

Yes, you can use the tax credit if you financed your solar with a loan. Many solar loans require you to apply the full credit to your loan balance within a specified timeframe to maintain lower payments. Ensure you have the funds to meet this requirement.

What types of property qualify for the federal tax credit?

Solar panels installed on various property types, including houseboats, mobile homes, and condominiums, are eligible if they meet all other criteria. Off-grid installations and batteries also qualify for the tax credit.

Can I claim the tax credit for solar installations on a rental property?

No, unless you reside in the rental property, you can’t claim the Residential Clean Energy Credit. However, rental properties may qualify for the commercial solar tax credit (IRC Section 48).

Can I claim the tax credit on a vacation home?

Yes, you can claim the tax credit for solar installations on secondary residences, but ensure your vacation home meets the requirements.

Does battery storage qualify for the federal tax credit?

Yes, both connected and standalone battery storage systems qualify for the federal tax credit, thanks to recent legislative changes.