Image source: Canva.com

Many people want to use solar power to save money on their energy bills. But if you have bad credit, you might think you can’t get solar panels. Don’t worry! There are still ways to go solar, even with bad credit.

Options for Solar with Bad Credit

If your credit isn’t great, you still have options like solar loans, leases, and power purchase agreements (PPAs). While these might come with higher interest rates or require larger down payments, they can help you get started with solar power.

If you have the means, paying for your solar panels in cash is another option – though it requires a significant upfront investment.

Before making a decision, it’s important to explore and compare your options. Reach out to a solar company or financial institution to find the best solution for your needs. Remember, going solar is a smart investment for both the environment and your finances, even if your credit isn’t perfect.

Disclaimer: This article offers an informational overview of solar loan fees for homeowners interested in solar products. It does not constitute financial advice. Readers considering solar installations should exercise discretion and consult a licensed professional before making any purchases or investments.

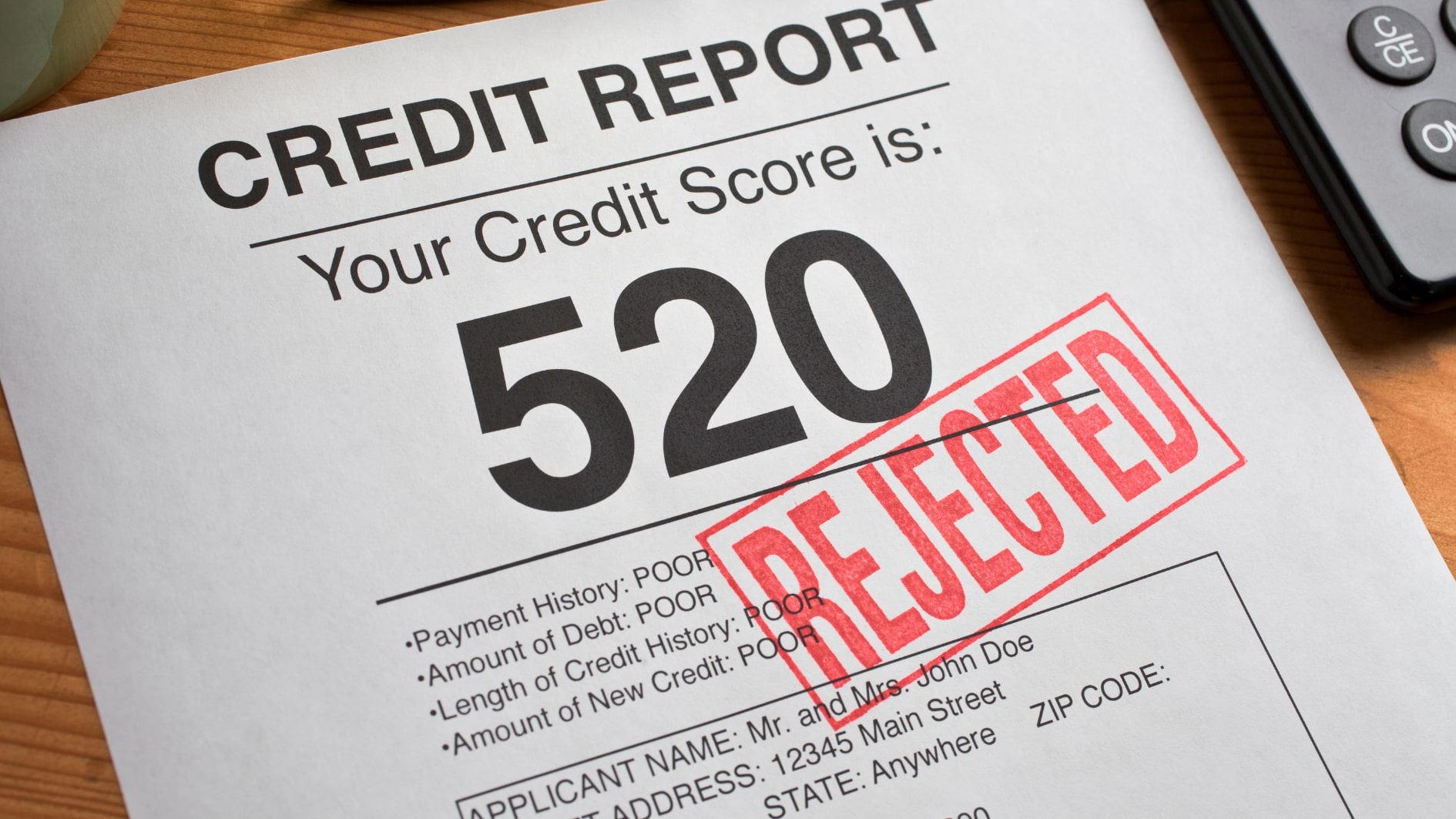

What Is Bad Credit

Bad credit typically refers to a history of missed payments, delinquencies, or other credit issues that can make it harder to get approved for loans or credit cards. Lenders see those with bad credit as higher-risk borrowers, which often means higher interest rates and larger down payments are required.

Key Points to Consider:

- Check your credit score and review your credit report.

- Look into non-traditional solar financing options that might accept lower credit scores.

- Some states and non-profit organizations offer solar programs for low-income households.

- If you’re thinking of going solar soon, work on improving your credit in the meantime.

Can You Get Solar Panels with Bad Credit?

Yes, having bad credit doesn’t mean you can’t get solar panels. It might make the process more challenging, but it’s still possible. Solar companies usually check your credit to see what financing options you qualify for, like loans, leases, or PPAs.

Types of Solar Financing

Loans

Solar loans are designed specifically for financing solar panel installations. They often have lower interest rates and longer repayment terms than regular personal loans. However, getting a solar loan with bad credit can be tough, and you might need a co-signer or collateral.

Leases

With a solar lease, you pay a fixed monthly fee to use the solar panels, without needing a credit check. While this can work for those with bad credit, it might cost more in the long run, and leased panels may not add as much value to your home as purchased ones.

PPAs

A Power Purchase Agreement lets you buy the electricity produced by the solar panels installed on your property at a fixed rate. PPAs don’t require a credit check or upfront payment, but they might be more expensive over time and could complicate selling your home.

Government Incentives and Grants

Many states and the federal government offer incentives, such as rebates and tax credits, to reduce the cost of installing solar panels. Programs like the Solar Investment Tax Credit (ITC) can make solar power more accessible and affordable, even if you have bad credit.

Improving Your Credit Score

If your credit needs a boost, here are some easy ways to improve it:

Consult a credit counselor

The National Foundation for Credit Counseling (NFCC) offers free consultations to help you manage debt and improve your credit score.

Monitor your credit regularly

Use free apps like Experian or Credit Karma to keep an eye on your credit score and get tips on how to improve it.

Make a plan

Focus on paying bills on time, reducing debt, and using secured credit cards to build your credit history.

Protect your personal information

Keep an eye on your credit report for any unusual activity and report any signs of fraud immediately.

By taking these steps, you can improve your credit score, making it easier to finance solar panels and secure your financial future.

Finding the Right Solar Loan

To find the best solar loan for your needs, research different options and compare interest rates. Look into any fees, read reviews of the lender, and carefully consider the repayment terms.

Working with a trusted solar installer and lender can help ensure you make the right decision.

Solar Loans: An Attractive Financing Option

Getting a Solar Panel Loan with a Co-Signer

If bad credit is preventing you from getting solar panels, having a co-signer with a good credit history can help. A co-signer agrees to take responsibility for the loan if you can’t make payments, which makes it easier for lenders to approve your loan.

This option can help you access solar energy, even if your credit isn’t strong.

How to Choose Between Leasing and Buying Panels for Solar Power

Choosing Between Leasing and Financing Solar Panels

When deciding between leasing and financing, it’s important to know the differences. With a solar lease, you don’t own the panels, and the leasing company usually gets any tax credits. Leases often last around 20 years, and at the end, you can choose to buy the panels, extend the lease, or have them removed.

If you finance your panels with a solar loan, you own the panels and can benefit from tax credits. Financing usually offers lower interest rates than leasing and gives you more flexibility.

Remember, having bad credit doesn’t mean you can’t go solar. It might take more time and effort, but there are still ways to get clean, cheap energy for your home. Don’t give up on your solar dreams!