Image source: Canva.com

The Federal Solar Tax Credit, or the Investment Tax Credit (ITC), is a powerful incentive for homeowners and businesses to invest in solar energy systems. In this comprehensive guide, we will cover everything you need to know about the federal solar tax credit in 2024.

What is the Federal Solar Tax Credit?

The Federal Solar Tax Credit is a dollar-for-dollar reduction in the amount of income tax you owe to the federal government. The credit is based on a percentage of the cost of your solar energy system, including installation and equipment expenses.

Disclaimer: The information presented in this article is meant to offer a general understanding of the Federal Solar Tax Credit for homeowners considering solar installations. However, it should not be taken as official financial advice. Do not rely solely on the information provided below when making purchasing decisions, investment decisions, tax decisions, or executing any other legally binding agreements. Always consult additional reputable sources of information and qualified professionals before making important financial, legal, or tax-related choices.

Eligibility for the Federal Solar Tax Credit in 2024

To be eligible for the Federal Solar Tax Credit in 2024, according to the Office of Energy Efficiency & Renewable Energy, you must:

1. Install qualifying equipment: Eligible equipment includes solar panels, solar shingles, solar water heaters, residential wind turbines, geothermal heat pumps, fuel cells, and battery storage systems.

2. Own the system: To claim the tax credit, you must purchase the solar panels with cash or a loan. Systems installed through a solar lease or power purchase agreement (PPA) do not qualify since you do not own the system.

3. Have taxable income: The tax credit reduces your tax liability. If your tax liability is zero, you cannot immediately take advantage of the incentive. However, you may be able to roll the credit forward to offset future tax bills.

4. Install at your primary or secondary residence: The system must be installed at your primary or secondary residence. Rental properties do not qualify for the federal tax credit.

5. Claim on original installation: The tax credit must be claimed on the initial installation of the equipment. You cannot reclaim the tax credit if you move the panels to another property or install used solar panels. However, you can claim the tax credit for costs incurred when adding new solar panels to an existing system.

Federal Solar Tax Credit Rates for 2024

The Federal Solar Tax Credit rates for 2024 are as follows:

- Residential solar energy systems: 30%

- Commercial solar energy systems: 30%

These rates apply to systems installed and placed in service between January 1, 2022, and December 31, 2024.

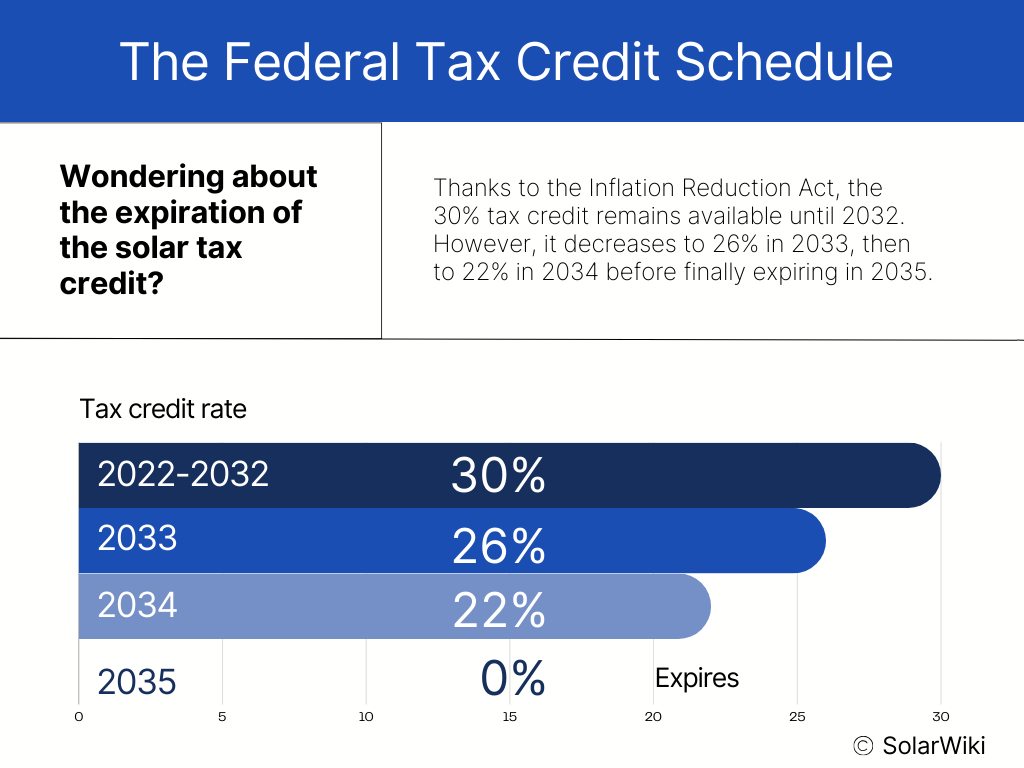

Here is the Federal Tax Credit Schedule as of 2024:

Claiming the Federal Solar Tax Credit

To claim the Federal Solar Tax Credit, you must:

1. Complete IRS Form 5695 and attach it to your federal income tax return

2. Calculate the credit based on the cost of your solar energy system and the applicable percentage for the year of installation

3. Apply the credit to your income tax liability for the year the system was installed and placed in service

If your Federal Solar Tax Credit exceeds your income tax liability for the year, you can carry the unused portion of the credit forward to future tax years.

Example Calculation

Let’s say you install a residential solar energy system in 2024 for $20,000. The federal solar tax credit would be calculated as follows:

$20,000 x 30% = $6,000

In this example, you would be eligible for a $6,000 federal solar tax credit, which you can apply to your 2024 income tax liability or carry forward to future tax years if the credit exceeds your liability.

Additional Considerations

There is no maximum limit on the amount of the federal solar tax credit for systems placed in service after January 1, 2022.

The Federal Solar Tax Credit is set to decrease to 26% for systems installed in 2033 and 22% for systems installed in 2034. After 2035, the residential credit will expire, while the commercial credit will remain at 10%.

Always consult with a qualified tax professional to ensure you are eligible for the credit and to help you navigate the claiming process.