Image source: Canva.com

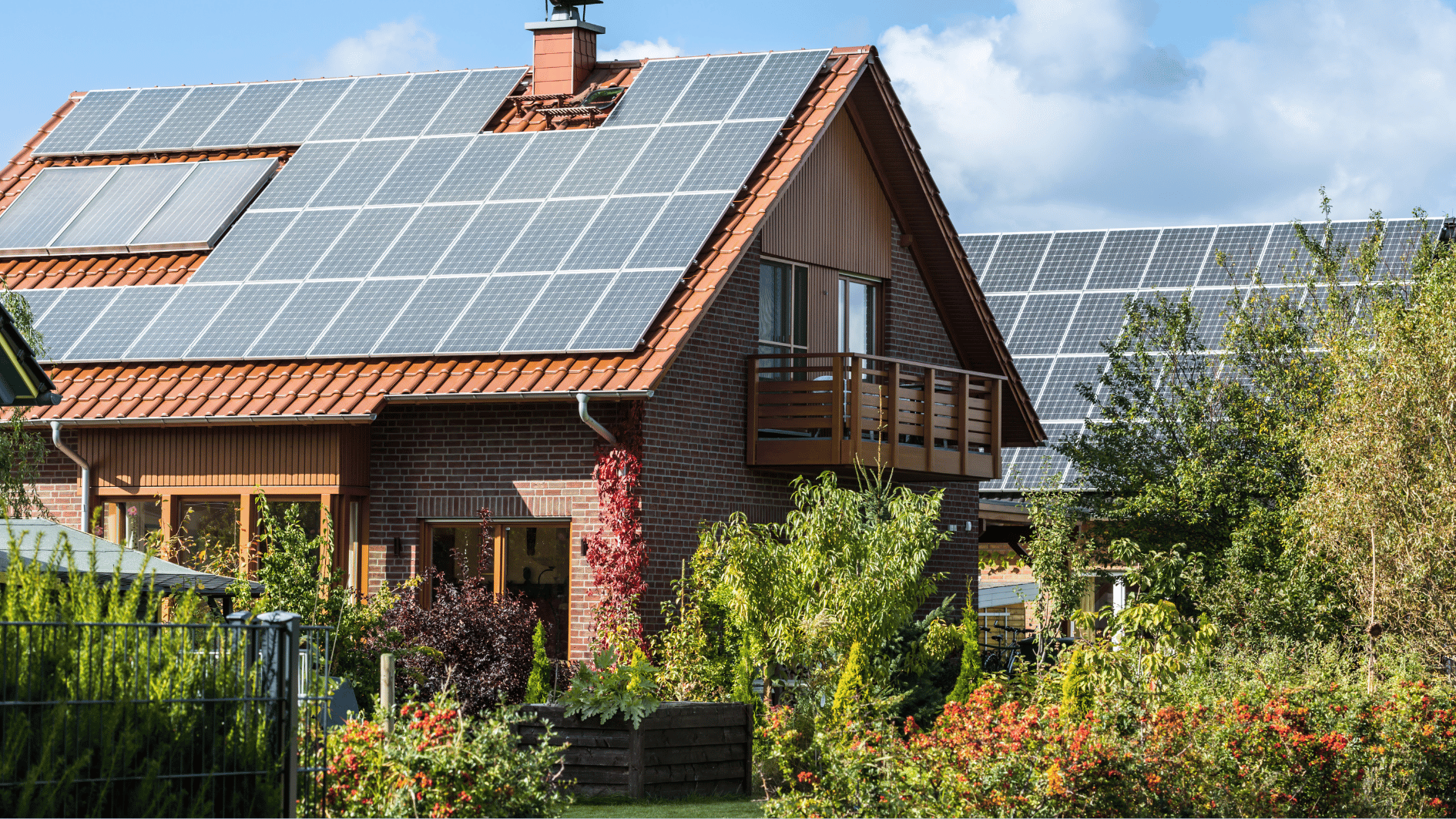

Iowa may not be the first state that comes to mind when you think of solar energy, but it has steadily emerged as a viable location for solar power due to its favorable incentives, net metering policies, and strong support for renewable energy development. While Iowa is best known for its wind energy, solar power has also been gaining traction, with more homeowners and businesses opting for solar installations. So, is going solar worth it in Iowa? Let’s explore the factors that make it a good choice, as well as the benefits and challenges involved.

Solar Potential in Iowa: Is There Enough Sunlight?

The first consideration when evaluating the value of solar energy in any location is the amount of sunlight the state receives. Iowa experiences around 200 to 210 sunny days per year, which is comparable to other Midwestern states and provides enough sunlight to make solar energy a viable option. While it’s not as sunny as states like Arizona or California, Iowa still receives sufficient solar radiation to support the efficient operation of solar panels year-round.

Additionally, Iowa’s geography, with open flat land and few natural obstructions, enhances the ability of solar panels to capture sunlight efficiently. This makes rooftop and ground-mounted solar systems practical, ensuring that even smaller installations can produce significant energy throughout the year.

Can Solar Panels Save You Money?

Why Solar Makes Sense in Iowa

Iowa’s energy landscape is already dominated by renewable energy sources, with wind power leading the way. However, solar energy is rapidly growing due to a mix of economic factors and supportive state policies. Here’s why going solar can be a smart decision in Iowa:

Generous State and Federal Incentives

Iowa offers various incentives to support solar adoption, including the state solar tax credit and net metering programs. When combined with the federal Investment Tax Credit (ITC), which allows homeowners to deduct 30% of the cost of their system from federal taxes, the financial burden of going solar is significantly reduced, making it more affordable for the average homeowner.

Net Metering Program

Iowa has a statewide net metering policy that allows solar customers to receive credit for the excess electricity their systems produce. This credit can be used to offset electricity costs at other times, such as during the night or in the winter months when the system might generate less energy. Net metering is a critical factor in making solar economically viable, as it helps shorten the payback period and increase the overall return on investment.

Environmental Benefits and Support for Clean Energy

Iowa has a strong track record in renewable energy, primarily due to its extensive wind energy industry. By adding solar power to the mix, the state is further diversifying its energy portfolio and reducing its reliance on fossil fuels. This makes going solar an appealing option for homeowners and businesses looking to reduce their carbon footprint and contribute to the state’s clean energy goals.

Do Solar Panels Add Value to Your Property?

Solar Incentives and Policies in Iowa

Iowa offers several key incentives that make solar energy more accessible and financially rewarding for residents:

Iowa State Solar Tax Credit

One of the most attractive incentives in Iowa is the state solar tax credit, which allows homeowners to claim 15% of the total cost of their solar installation as a credit on their state income taxes. This credit is capped at $5,000 for residential systems and $20,000 for commercial systems. While the program’s future funding can fluctuate, it has historically been a valuable tool for making solar more affordable.

Net Metering

Iowa’s net metering policy is offered by the state’s major utilities, including Alliant Energy and MidAmerican Energy. Under this program, excess electricity generated by a solar system is credited at the full retail rate, which can be used to offset future electricity bills. This ensures that homeowners receive fair compensation for the energy they produce, making it easier to achieve a faster payback period.

Federal Investment Tax Credit (ITC)

Like other states, Iowa residents are eligible for the federal ITC, which currently allows homeowners to deduct 30% of the cost of a solar system from their federal taxes. This incentive can save thousands of dollars on a typical solar installation.

Property Tax Exemption

Iowa’s solar property tax exemption prevents homeowners from facing higher property taxes due to the increased value of their property after installing a solar system. This ensures that while solar panels boost home value, they don’t lead to a higher property tax bill.

Sales Tax Exemption

Iowa does not offer a specific solar sales tax exemption, so homeowners should factor this cost into the overall budget for their solar project.

Iowa’s Key Solar Incentives: A Breakdown

Potential Challenges of Going Solar in Iowa

Despite the many benefits, there are a few challenges to consider when deciding whether to go solar in Iowa:

Uncertainty Around Net Metering

While net metering is currently available in Iowa, the policy has been under review and could change in the future. If the policy is altered or phased out, it could reduce the financial return for new solar installations, making it less attractive for some homeowners. Staying informed about potential policy changes is crucial when planning a solar project.

Upfront Costs

Although incentives help reduce the cost, the initial investment for a solar system can still be a significant financial commitment. Many homeowners choose to finance their systems through solar loans, power purchase agreements (PPAs), or leases, which can make the upfront cost more manageable.

Weather Variability

While Iowa has ample sunlight, it also experiences variable weather conditions, including snow and cloudy days. These factors can temporarily reduce solar output, but with a properly designed system, this variability can be managed to ensure year-round energy production.

Smaller Market and Installer Availability

Compared to states with more established solar markets, Iowa’s solar industry is smaller, which may limit the availability of local installers and the variety of financing options. However, the industry is growing, and more companies are entering the market to meet the increasing demand.

Is Going Solar Worth It in Iowa?

Yes, going solar in Iowa can be a worthwhile investment for many homeowners and businesses, thanks to the state’s favorable incentives, net metering policy, and the long-term savings potential. The combination of the federal ITC and the state solar tax credit significantly reduces the upfront cost, while net metering ensures that homeowners receive fair compensation for the energy they produce.

The payback period for solar installations in Iowa typically ranges from 9 to 12 years, depending on the system size, electricity rates, and available incentives. After the system has paid for itself, homeowners can enjoy decades of free electricity, making solar a smart long-term investment.

If you’re considering going solar in Iowa, it’s essential to evaluate your energy needs, compare local installers, and stay up-to-date on any policy changes that could impact your savings. With the right approach and system design, solar energy can offer significant environmental and financial benefits, making it a bright opportunity for homeowners and businesses in the Hawkeye State.